nevada estate and inheritance tax

However an estate in Nevada is still subject to federal inheritance tax. More on Money and Taxes.

Do I Have To Worry About A Nevada Inheritance Tax No Nevada Is Among The Majority Of States That Does Not Impose An I Inheritance Tax Nevada Tax Questions

Inheritance tax of up to 16 percent.

. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. Of the six states with inheritance taxes Nebraska has the highest top rate at 18 percent. There are extreme cases where an estate will still need to pass through probate even if the decedent had.

Eight states and the District of Columbia are next with a top rate of 16 percent. The probate process is not required in Nevada if the decedent has set up a trust or family trust which in most cases helps their estate to avoid probate. Nevada offers an abundance of tax advantages for relocating home and business owners alike including.

Nevada Inheritance Tax and Estate Tax. However if those trusts or plans were not made the only way estate assets can be distributed in Nevada is through the probate. No Estate Tax Laws in Nevada To beneficiaries of an estate learning that inherited property is located in Nevada can feel like watching all three wheels of a slot machine land on the number 7.

Since the state does not impose an estate or inheritance tax upon death less money is deducted during probate than if the property was located in any other state in America. No personal income tax no state estate inheritance or gift tax lots of wide open spaces great entertainment and friendly people. In 2021 the first 117mil per individual is exempt at the federal level and therefore your estate will only pay tax if it is more than 117mil.

Inheritance tax and estate tax refer to the taxes you must pay on property you receive from someone who is deceased. For use in protecting assets from taxes for generations. Nevada does not have these kinds of taxes which some states levy on people who either owned property in the state where they lived estate tax or who inherit property from someone who lived there inheritance tax.

Because of the phaseout of the federal estate tax Nevada does not require an estate tax filing for decedents whose date of death was Jan. These 15 Countries Pay More in Taxes Than Americans. If the time of death is on or after January 1 2005 Nevada does not require filing of Estate Tax and will not require filing.

Although it did have one prior to the year 2005 it has been phased out. Does Nevada Have an Inheritance Tax or Estate Tax. Hunting is a favorite pastime of many residents.

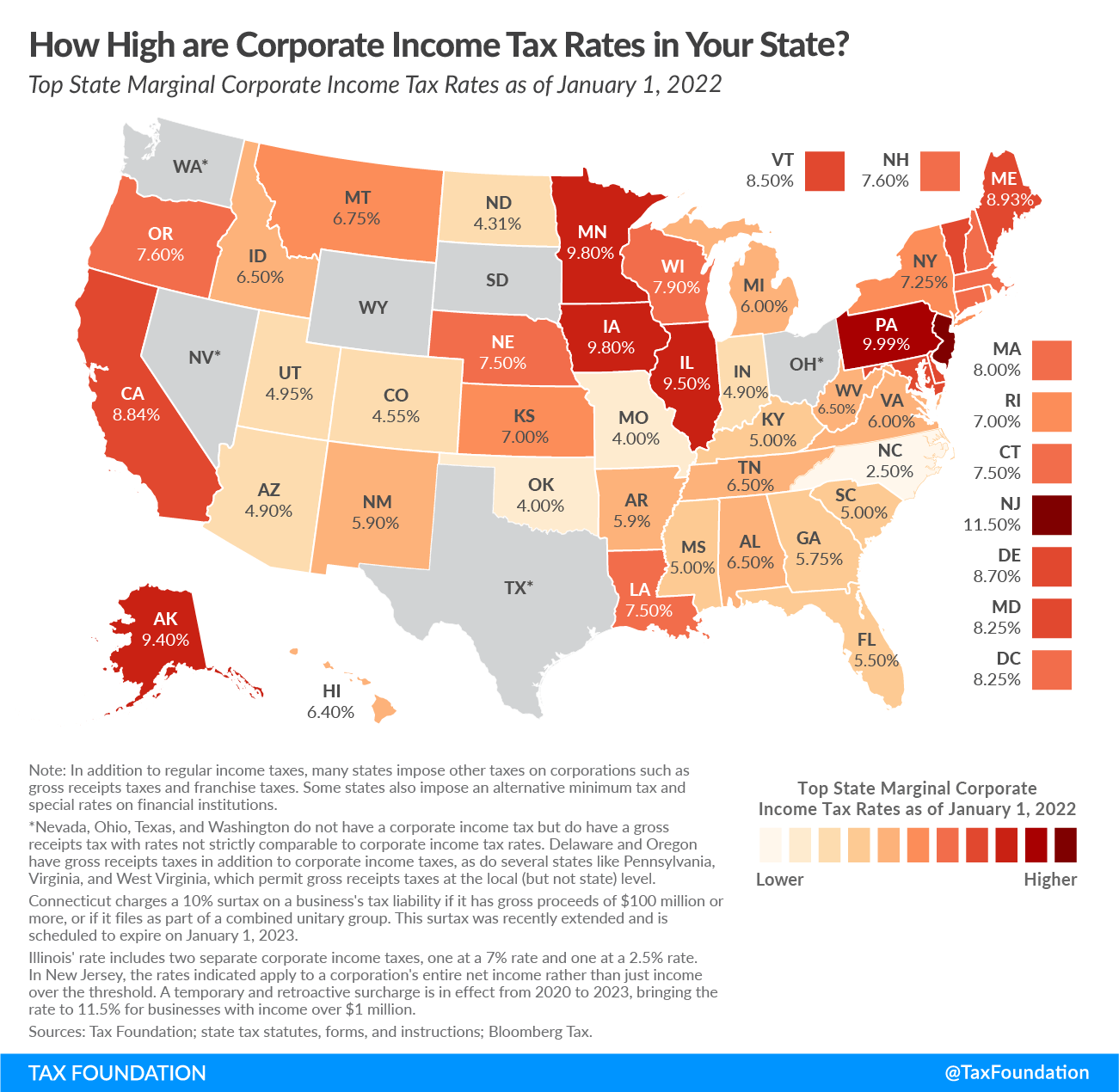

No gross receipts tax. Inheritance tax of up to 15 percent. Wells Fargo Can Help Work with You Your Team of Advisors.

Massachusetts and Oregon have the lowest exemption levels at 1 million and Connecticut has the highest exemption level at 71 million. Ad Get The Financial Information You Need to Create Your Trust Fund. No estate tax or inheritance tax.

Ad Inheritance and Estate Planning Guidance With Simple Pricing. The top inheritance tax rate is 16 percent no exemption threshold New Mexico. The good news also is that the IRS does not impose an inheritance tax.

5740 million North Carolina. Estate tax of 306 percent to 16 percent for estates above 59 million. The alternate valuation is only available if it will decrease both the gross amount of the estate and the estate tax liability.

The top estate tax rate is 16 percent exemption threshold. Estate taxes are levied on the total value of a decedents property and must be paid out before distributions are made to the decedents beneficiaries. It is one of the 38 states that does not apply an estate tax.

Nevada has no estate or inheritance tax. Like most states Nevada does not have an estate tax or an inheritance tax. Nevada gift tax and inheritance tax planning.

Keep reading for all the most recent estate and inheritance tax rates by state. 1 2005 or after. The difference between inheritance and estate tax is a matter of who is responsible for paying the tax.

There is no inheritance tax in Nevada. No estate tax or inheritance tax. NV does not have state inheritance tax.

A federal estate tax ranging from 18 to 40. Under Nevada law there are no inheritance or estate taxes. State estate and inheritance tax treatment of 529 plans.

Thats why Nevada is such a tax friendly state. No estate tax or inheritance tax. Whereas the inheritance tax is calculated separately for each individual beneficiary and the beneficiary is.

Anything more than 117mil can be taxed up to 40. This is a tax that is assessed when beneficiaries receive money from an estate. Nevada residents do not need to worry about a state estate or inheritance tax.

Inheritance tax of up to 18 percent. Since Nevada collects so much in gaming taxes they do not impose an inheritance tax or a gift tax. Estate tax of 10 percent to 16 percent on estates above 1 million.

Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. Federal estate tax The federal estate tax will be applied if your inheritance is more than 1158 million in 2020 though. Nevada filing is required in accordance with Nevada law NRS 375A for any decedent who has property located in Nevada at the time of death December 31 2004 or prior and whose estate value meets or exceeds the level requiring a Federal Estate Tax return.

No estate tax or inheritance tax. Inheritance tax from another state Even though Nevada does not levy an inheritance tax if you inherit an estate from someone living in a state that does have an inheritance tax you will have to pay it even though you live in Nevada.

Nevada Tax Advantages And Benefits Retirebetternow Com

Do I Have To Worry About A Nevada Inheritance Tax No Nevada Is Among The Majority Of States That Does Not Impose An I Inheritance Tax Nevada Tax Questions

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Nevada Trusts Safeguarding Personal Wealth Northern Trust

If You Want To Avoid Paying Lots Of Taxes You Might Want To Steer Clear Of The Northeast And Venture Towards Th Best Places To Retire Retirement Locations Map

If You Want To Avoid Paying Lots Of Taxes You Might Want To Steer Clear Of The Northeast And Venture Towards Th Best Places To Retire Retirement Locations Map

Why Your Family S Money Belongs In Nevada No Matter Where You Live

Nevada Income Tax Calculator Smartasset

Historical Nevada Tax Policy Information Ballotpedia

Your Estate Plan Be Aware Of New Laws Estate Planning How To Plan New Law

Nevada Real Estate Transfer Taxes An In Depth Guide

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Nevada Vs California Taxes Explained Retirebetternow Com

Nevada Tax Advantages Luxury Real Estate Advisors

States Where Residents Are Most Satisfied Estate Tax Inheritance Tax Nightlife Travel

Greetings From Nevada Vintage Postcard Etsy Vintage Postcard Postcard Greetings